Top 10 Forex Currency Trading Strategies Every Trader Should Know!

By EoneFX Insights

10 December 2024

Picture this: You’ve just opened your first forex trading account, and the charts before you flicker with endless possibilities. Markets are moving fast, but your decisions need to be precise. Amid the excitement, one question looms: What’s the best way to trade forex successfully?

This is where a well-structured forex trading strategy becomes your roadmap to success. In the world of forex, strategies are not just tools—they’re lifelines. Whether you’re a beginner testing the waters or a seasoned trader navigating volatile trends, a tailored strategy can make all the difference. Let’s delve into the top 10 forex trading strategies that every trader should know to elevate their trading game.

What is a Forex Trading Strategy?

A forex trading strategy is a set of rules and techniques that traders use to determine when to buy or sell currency pairs. These strategies combine technical analysis, market sentiment, and economic data to guide decisions. The primary goal? Minimize risk and maximize profitability.

Forex trading strategies can range from simple methods, like using moving averages, to complex systems involving advanced indicators and algorithms. The key is finding a strategy that aligns with your trading style, risk tolerance, and market conditions.

10 Best Forex Trading Strategies

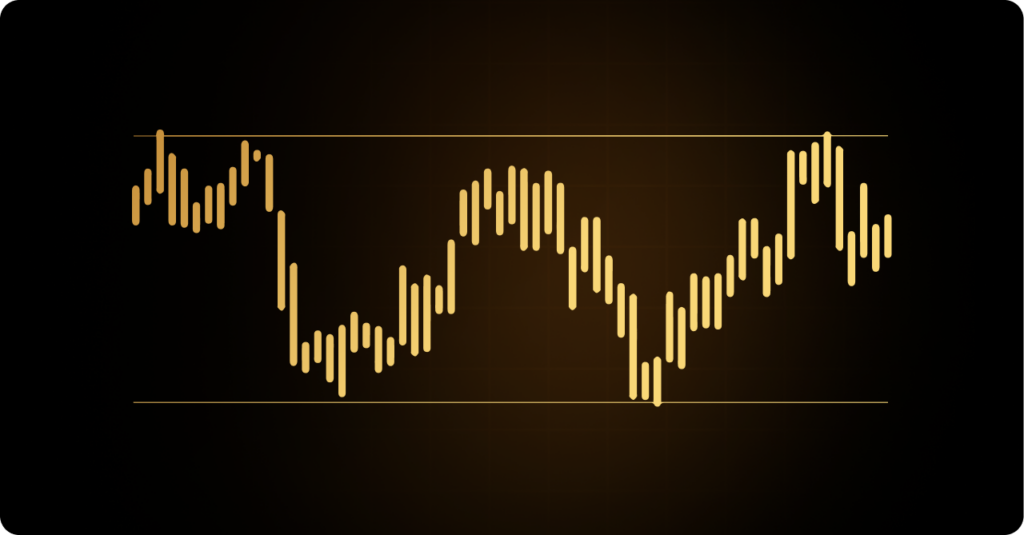

1. Range Trading Strategy

The range trading strategy revolves around identifying price levels where a currency pair consistently oscillates between support and resistance. Traders buy at the support level and sell at resistance.

Example:

Consider EUR/USD trading between 1.1000 and 1.1200. Traders could buy near 1.1000 and sell near 1.1200 repeatedly until the range breaks.

Benefits:

- Works well in stable markets.

- Low reliance on external factors.

Range trading strategies account for approximately 20%-30% of all forex trades, particularly in low-volatility markets.

2. Carry Trade Strategy

This strategy involves borrowing funds in a low-interest-rate currency to invest in a high-interest-rate currency. The goal is to profit from the interest rate differential, also known as the “carry.”

Example:

A trader borrows Japanese yen (low interest) to buy Australian dollars (high interest) and earns interest on the difference.

Benefits:

- Generates consistent returns if market conditions remain stable.

- Ideal for long-term trades.

Risks:

- Vulnerable to exchange rate fluctuations.

Carry trades are most effective when interest rate differentials exceed 2%. In 2021, the AUD/JPY pair saw significant carry trade activity due to favorable rate differentials.

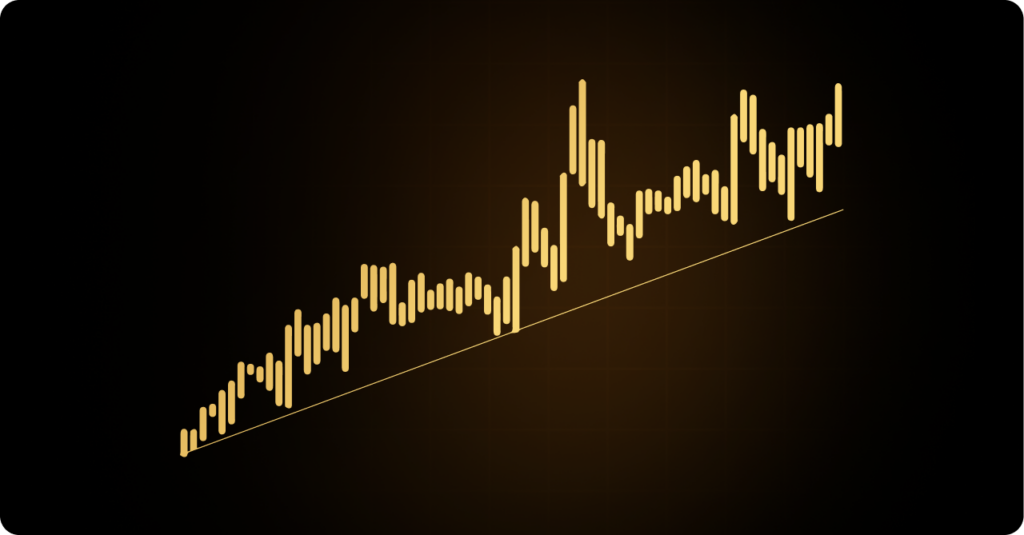

3. Trend Trading Strategy

The trend trading strategy is about identifying and riding the market trend, whether bullish or bearish. Traders use indicators like moving averages or the MACD to confirm trends.

Example:

During a strong USD uptrend, traders might look to buy USD/JPY and hold as long as the uptrend persists.

Benefits:

- Works well in high-volatility markets.

- Easy to implement with technical indicators.

Trend-following strategies are among the most popular, with nearly 40% of professional traders relying on them.

4. News Trading Forex Strategy

News trading involves making trades based on significant economic announcements, such as interest rate changes or employment data. This strategy exploits the market’s immediate reaction to news.

Example:

A trader might go long on GBP/USD if the Bank of England announces a surprise interest rate hike.

Benefits:

- High-profit potential during major news releases.

- Short-term results.

Risks:

- Highly volatile and unpredictable.

Tip:

Keep an eye on economic calendars to identify potential news events.

5. Breakout Trading Strategy

This strategy focuses on trading price movements when they break through key support or resistance levels. Breakouts often lead to strong momentum in the breakout direction.

Example:

If USD/CHF breaks above a resistance level of 0.9200, traders might go long, expecting further upward movement.

Benefits:

- Profitable in volatile markets.

- Provides clear entry and exit points.

Risks:

- False breakouts can lead to losses.

Statistics:

Breakout strategies are particularly effective in the London and New York trading sessions, where liquidity peaks.

6. Grid Forex Trading Strategy

Grid trading involves placing buy and sell orders at predefined intervals above and below a set price, creating a “grid” of trades. This strategy is often automated.

Example:

A trader sets buy orders every 10 pips above 1.2000 and sell orders every 10 pips below 1.2000 on EUR/USD.

Benefits:

- Profits from volatility without predicting direction.

- Works well in range-bound markets.

Risks:

- Requires significant capital to manage multiple positions.

7. Retracement Trading Forex Strategy

Retracement trading focuses on temporary price reversals within a larger trend. Traders use Fibonacci retracement levels to identify potential entry points.

Example:

If GBP/USD is in an uptrend and retraces to the 50% Fibonacci level, traders might go long, anticipating the trend’s continuation.

Benefits:

- Provides low-risk entry points.

- Aligns with broader market trends.

Retracement strategies account for 15%-20% of all forex trades, often used in trending markets.

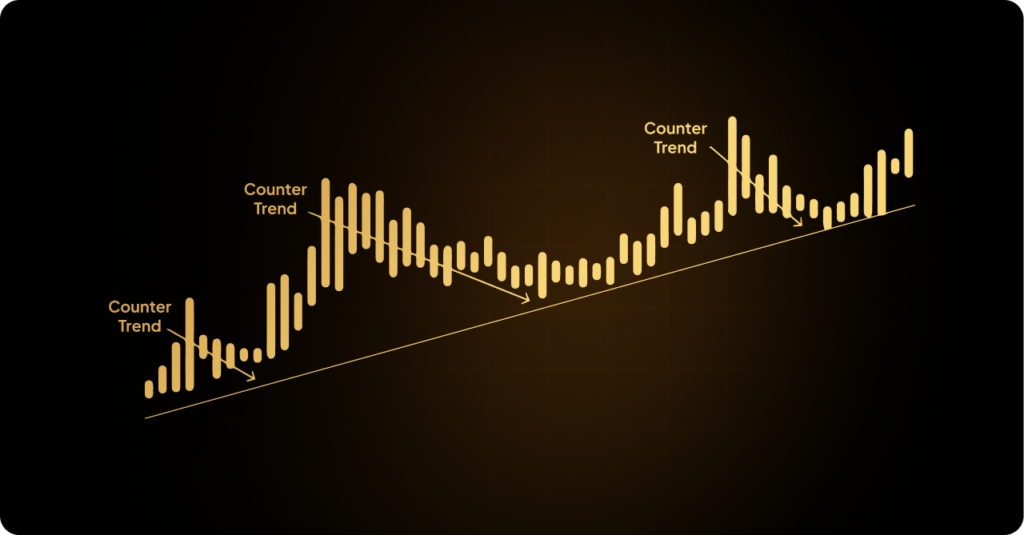

8. Counter-Trend Forex Strategy

Counter-trend trading involves trading against the prevailing market trend, aiming to capitalize on short-term corrections.

Example:

A trader shorts AUD/USD during a temporary pullback in an overall uptrend.

Benefits:

- High-profit potential during corrections.

- Works well in overbought or oversold conditions.

Risks:

- Riskier than trend-following strategies.

9. One-Hour Forex Strategy

The one-hour strategy focuses on trades executed and closed within a one-hour timeframe. Traders use short-term indicators like Bollinger Bands and moving averages.

Example:

A trader buys EUR/JPY when it crosses above the 20-period moving average on a 1-hour chart.

Benefits:

- Ideal for intraday traders.

- Reduces overnight exposure.

Risks:

- Requires constant monitoring.

10. Scalping Strategy

Scalping involves making numerous small trades throughout the day to profit from minor price movements. Trades are often closed within minutes.

Example:

A trader might make 10-20 trades in a single session on USD/JPY, targeting 5-10 pips per trade.

Benefits:

- Quick returns in volatile markets.

- Minimal market exposure.

Scalping strategies account for 10%-15% of forex trades, popular among high-frequency traders.

How to Choose the Best Forex Trading Strategy for You

- Evaluate Your Risk Tolerance:

High-risk strategies like news trading may not suit all traders. - Consider Your Time Commitment:

Strategies like scalping require constant attention, while swing trading allows more flexibility. - Test in a Demo Account:

Use a demo account to assess strategy performance in a risk-free environment.

How to Compare Forex Strategies

- Profitability: Analyze historical performance data.

- Complexity: Choose a strategy that matches your skill level.

- Market Conditions: Ensure the strategy aligns with current market behavior.

Conclusion

Mastering forex trading starts with understanding the strategies at your disposal. From trend trading and scalping to news and breakout strategies, each approach has unique benefits and risks. By testing and refining these strategies, you can find the one that aligns with your trading goals and style.

Ready to implement these strategies? Start trading today with EoneFX, your partner for successful forex trading.