What’s the difference between a Forex demo and live account?

By EoneFX Insights

26 November 2024

Forex trading, one of the largest financial markets globally, offers unique opportunities for traders of all experience levels. Central to any trading journey is understanding the tools at your disposal, particularly the types of accounts available. The two most common types are live accounts and demo accounts. While both serve critical roles in a trader’s development, they differ significantly in terms of purpose, functionality, and outcomes.

This blog will explore these differences, outline the benefits and limitations of each account type, and provide actionable insights to help you decide which account aligns with your goals. Whether you’re new to trading or an experienced investor looking to refine your strategies, understanding these accounts is essential.

What is a Forex Live Account?

A forex live account enables traders to engage in real-time trading using actual money. With a live account, every trade is connected to the global forex market, where real profits and losses are made. It is designed for traders who are ready to put their strategies into action with financial stakes involved.

Key Features of a Forex Live Account

- Real-Time Market Access

Live accounts connect traders to the real forex market, allowing them to trade currency pairs at live prices. - Leverage and Margin

Traders can use leverage to control larger positions with smaller deposits, amplifying both profits and risks. - Advanced Tools

Brokers provide tools like economic calendars, charting platforms, and indicators tailored for live trading. - Full Market Conditions

Real market conditions, including slippage, spreads, and price fluctuations, are reflected in live accounts.

Benefits of a Forex Live Account

- Experience Real Markets: Gain firsthand insights into market behavior and dynamics.

- Profit Potential: Opportunity to generate real returns based on successful trades.

- Skill Refinement: Develop strategies that align with market conditions.

Challenges of a Forex Live Account

- Financial Risk: Live accounts carry the potential for real losses.

- Emotional Pressure: The financial stakes can lead to stress, affecting decision-making.

Example:

A trader using a live account in Dubai with 1:100 leverage might control a $10,000 position by investing $100. While this setup increases potential profits, it also amplifies losses if the market moves unfavorably.

What is a Forex Demo Account?

A forex demo account provides traders with a simulated trading environment where they can practice and test strategies without risking real money. It is an essential tool for beginners and experienced traders looking to refine their techniques.

Key Features of a Forex Demo Account

- Virtual Funds

Demo accounts operate with virtual money, removing financial risks. - Simulated Market Conditions

Traders can engage in simulated trades, mimicking the movements of live markets. - Comprehensive Platform Access

Demo accounts allow users to familiarize themselves with broker tools and features. - Risk-Free Practice

Perfect for testing strategies without the fear of losing real capital.

Benefits of a Forex Demo Account

- Risk-Free Environment: Ideal for understanding market dynamics without financial consequences.

- Platform Familiarity: Get accustomed to the broker’s trading interface and tools.

- Strategy Testing: Experiment with various strategies in a safe, controlled setting.

Limitations of a Forex Demo Account

- No Emotional Pressure: Without financial risks, traders may not develop emotional discipline.

- Execution Differences: Market conditions such as slippage or liquidity may not reflect real scenarios.

Example:

A beginner trader practicing on a demo account with $50,000 virtual funds can test strategies without risking real money.

Key Differences Between Live and Demo Accounts

| Aspect | Live Account | Demo Account |

|---|---|---|

| Funds Used | Real money | Virtual funds |

| Risk | Financial risk with potential profits or losses | No financial risk |

| Emotional Impact | Triggers real emotions like fear and greed | Lacks emotional engagement |

| Execution | Prone to slippage and requotes | Ideal execution without market impact |

| Learning Focus | Real-world trading experience | Skill-building and strategy testing |

Why Are There Differences Between Demo and Live Accounts?

The discrepancies between live and demo accounts stem from execution conditions and trader psychology.

Execution-Related Differences

- Slippage and Spreads: Live accounts may encounter slippage or fluctuating spreads due to market volatility.

- Market Liquidity: Live accounts are subject to liquidity constraints, unlike demo accounts.

- Order Accuracy: Stop-loss and take-profit orders in live accounts might not execute at the exact levels due to market conditions.

According to Forex Traders, traders often report a 20% difference in execution between live and demo accounts.

Trader Psychology

- Emotional Engagement: Live trading introduces emotional pressure, influencing decisions.

- Overconfidence in Demo Accounts: The absence of real stakes in demo trading can lead to overtrading or unrealistic expectations.

Example:

A trader may comfortably risk 5% of their virtual capital in a demo account but limit risk to 1% in a live account.

Who Should Use a Forex Live Account?

Best For:

- Experienced Traders: Those confident in their strategies and ready to navigate real markets.

- Investors Seeking Real Profits: Traders looking to capitalize on their expertise.

- Disciplined Risk Takers: Individuals capable of managing emotional and financial risks.

Who Should Use a Forex Demo Account?

Best For:

- Beginners: Ideal for those starting their trading journey to build confidence.

- Strategy Testers: Perfect for experimenting with new techniques or unfamiliar platforms.

- Platform Explorers: Traders seeking to understand broker features and tools.

How to Transition from a Demo to a Live Account

- Start Small: Open a micro or mini account to ease into live trading.

- Apply Strategies: Use proven methods developed during demo trading.

- Monitor Results: Keep track of trades to identify strengths and weaknesses.

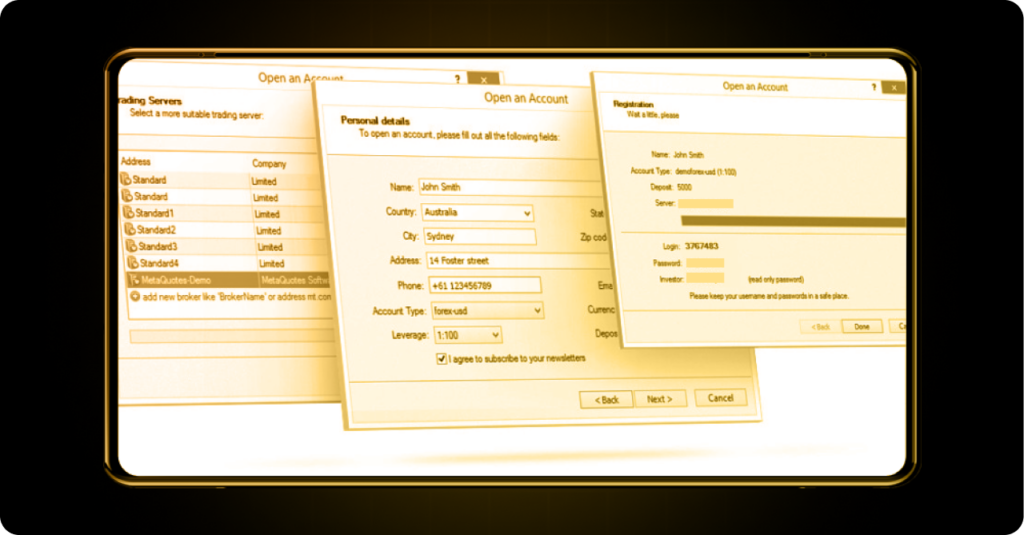

How to Open a Forex Live or Demo Account

Step-by-Step Process

- Choose a Broker: Select a reliable broker offering both account types.

- Register: Complete the registration form on the broker’s platform.

- Verify Documents: Submit identity and address proofs.

- Fund the Account (Live Account): Deposit the required funds.

- Start Trading: Begin exploring the forex market.

Conclusion

Forex live and demo accounts are vital tools for traders at different stages of their journey. While demo accounts are excellent for learning and testing, live accounts provide real-world experience with genuine financial stakes. By understanding their differences, traders can strategically utilize both to enhance their skills and achieve their trading goals.

Ready to take the next step? Open your forex live or demo account today with EoneFX and start your trading journey on the right foot.