CFD Trading

Understanding the Basics of CFD Trading

1. What is CFD Trading?

CFD trading, or Contracts for Difference trading, allows you to speculate on the price movements of assets like stocks, commodities, forex, and indices. Rather than buying or selling the actual asset, you enter a contract with your broker to exchange the price difference of that asset from when the trade is opened to when it’s closed. This means you can benefit from both rising and falling markets by choosing to go long (buy) or short (sell) on various instruments.

2. How Does CFD Trading Work?

When trading CFDs, you select an asset like gold, the EUR/USD currency pair, or the NASDAQ index and decide whether to buy or sell based on your analysis of the market’s direction. Your profit or loss depends on how much the price moves in the direction you chose. For instance, if you anticipate a rise in oil prices, you place a buy order.

If the price goes up, you gain; if it drops, you incur a loss. CFDs are traded on margin, which means only a fraction of the trade’s total value needs to be deposited upfront, allowing you to leverage your positions.

CFD Trading Essentials

1. You Can Go Long or Short with CFDs

With CFDs, you have the flexibility to trade in both directions:

- Going Long: Buy if you think the asset price will increase.

- Going Short: Sell if you expect the price to decrease.

This dual-direction trading makes CFDs especially attractive in volatile markets, such as forex, where prices can fluctuate significantly.

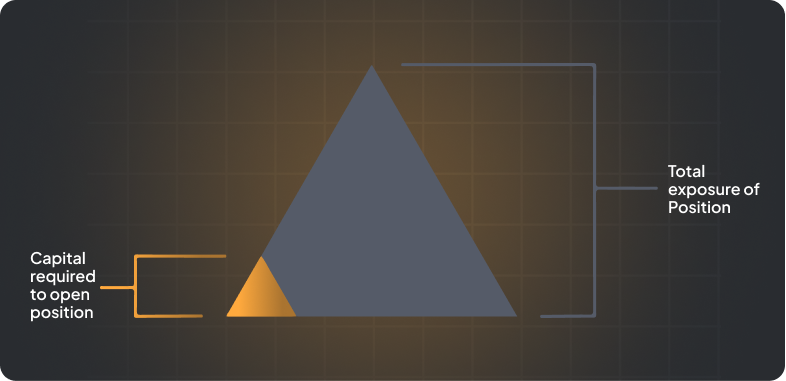

2. CFD Trading is Leveraged

Leverage enables you to control larger positions with a smaller deposit. While this can magnify your profits, it also increases the potential for losses, so risk management is essential. In the UAE, leverage ratios vary, so understanding the impact of leverage on your trades is important.

3. CFDs Reflect the Underlying Market

CFD prices track the prices of the underlying assets, meaning if the price of gold rises, the CFD price will mirror this movement. This ensures that your trades stay in sync with real market conditions, allowing for an accurate trading experience.

Is CFD Trading Right for Me?

CFD trading can be a rewarding option if you understand the risks and know how to manage them. Traders in Dubai and the UAE are increasingly turning to CFDs to diversify portfolios, manage risk, and take advantage of market movements.

Why Do People Trade CFDs?

- Leverage: Control larger positions with a smaller deposit.

- Flexibility: Access multiple markets from one platform.

- Extended Hours: Some CFD markets operate beyond standard hours.

- Hedging: Use CFDs to balance risks in other investments.

5 Steps to Becoming a CFD Trader

1. Understand How CFDs Work

Learn about the fundamentals of CFD trading, including the types of assets you can trade and how market prices fluctuate. Having a clear grasp of these basics will help you make informed decisions.

2. Know How CFD Profit and Loss Works

Your profit or loss depends on how much the asset price moves in relation to your trade. Using stop-loss orders and setting profit targets can help you manage potential risks.

3. Learn How to Place a CFD Trade

Practice on a demo account to familiarize yourself with buy and sell orders, as well as the platform's features. This allows you to build confidence before trading with real money.

4. Explore CFD Trading Timeframes

CFD trading is suitable for both short-term and long-term strategies. Choose a timeframe that aligns with your trading style, whether you prefer quick scalping trades or long-term investments.

5. Understand CFD Trading Costs

CFD trading involves spreads, commissions, and overnight fees. Being aware of these costs ensures you can accurately calculate potential profits and losses.

Conclusion

CFD trading offers exciting opportunities across forex, commodities, indices, and more. With the ability to go long or short, leverage your trades, and manage risks, CFDs are a versatile choice for traders in Dubai and the UAE. However, understanding risk management and the associated costs is essential for a successful trading experience.

Frequently Asked Questions

CFD brokers typically earn through *spreads*, *commissions*, and *overnight fees* on positions held past market close. Since fee structures differ across brokers, it’s important to review these carefully. For more details, visit our Trading Conditions page.

CFDs are often used as a hedging tool. If you have an existing investment at risk of a potential downturn, you can take a short CFD position to offset losses. This allows for more balanced portfolio management and risk control, especially during volatile markets.

CFDs and futures both allow you to trade on price movements, but with some key differences:

- Expiration: CFDs are open-ended, so you can hold positions as long as the market remains open. Futures, however, have a set expiration date.

- Contract Flexibility: CFDs offer customizable contract sizes, while futures contracts are standardized and traded on exchanges.

Generally, CFDs don’t expire, which means you can hold your positions as long as the market remains open and you cover any applicable costs. This gives you greater flexibility to align your positions with your trading strategy, whether short-term or long-term.