CFD Trading

Key Benefits and Risks of CFD Trading

CFD trading has gained popularity due to unique features like leverage, access to global markets, and the ability to trade in both directions. However, it’s essential to recognize the associated risks. Here, we break down the main benefits and risks to help you trade confidently and responsibly.

Benefits of CFD Trading

1. Make Your Capital Go Further with Leverage

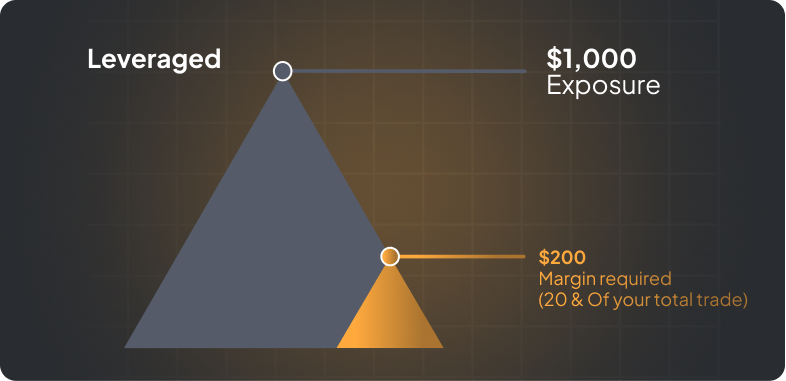

One of the primary attractions of CFD trading is the ability to use leverage. Leverage allows you to control a larger position with a smaller initial deposit, amplifying both potential profits and losses.

This feature provides more exposure in the market than your original investment, enabling you to capitalize on opportunities that might otherwise be out of reach.

2. Go Short or Long

CFDs allow you to profit from both rising and falling markets, a flexibility not available with all traditional investments:

- Go Long: Place a buy order if you expect the price to rise

- Go Short: Place a sell order if you anticipate a price drop.

This dual-direction trading is ideal for volatile markets, enabling you to benefit from market shifts in any direction.

3. Trade a Huge Range of Markets

CFDs provide access to a wide range of financial markets, all from a single trading platform. You can diversify your portfolio by trading assets like forex, commodities, indices, and shares. This breadth of options allows you to explore various market opportunities and tailor your trading strategies to different asset classes.

4. Mirror the Underlying Market

CFD prices closely track the underlying asset’s value, ensuring your trades reflect real-time market movements. This alignment with the live market lets you adjust your strategy based on current conditions, making CFD trading an effective choice for staying in sync with market trends.

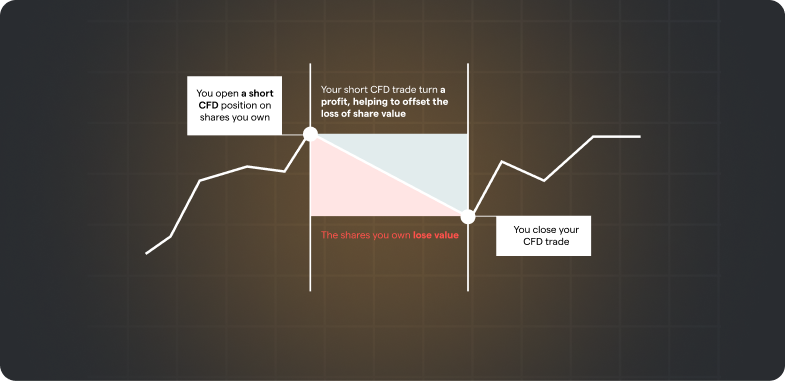

5. Hedge a Share Portfolio

CFDs can be used as a hedging tool to offset potential losses in an existing portfolio. For example, if your share holdings face a downturn, you can open a short CFD position on the same assets to help balance the decline. This flexibility makes CFDs an effective choice for risk management and protection against market fluctuations.

6. Access Direct Market Access (DMA)

Advanced traders can benefit from Direct Market Access (DMA), which provides access to real-time pricing and deeper liquidity pools. With DMA, you place trades directly in the market without broker intervention, making it a preferred choice for those seeking more precise control over their trades.

Risks of CFD Trading

While CFDs offer notable benefits, they also come with risks that can affect your trading experience if not carefully managed. Here are some key risks to consider:

1. Leverage Increases Both Profits and Losses

Leverage can work in your favor, but it also magnifies losses if the market moves against your position. In such cases, you could lose more than your initial investment. Risk management tools, like stop-loss orders, can help limit potential losses, but understanding the impact of leverage is crucial.

2. Market Volatility

The financial markets can be highly volatile, causing rapid price changes. While this volatility can present opportunities, it also increases the risk of sudden losses if trades are not carefully monitored. Traders should consider market conditions and manage their positions to avoid being caught off guard by unexpected shifts.

3. Overnight Costs

Holding CFD positions overnight incurs additional fees, known as swap rates or overnight financing costs. These fees can accumulate over time, impacting your overall returns. It’s essential to factor these costs into your strategy, especially if you plan on holding positions for extended periods.

4. Counterparty Risk

CFD trading is conducted through brokers rather than regulated exchanges, meaning there is a small risk that the broker may be unable to meet its financial obligations. This counterparty risk can be mitigated by trading with a regulated and reputable broker who operates under strict financial standards.

5. Emotional Trading

Due to leverage and fast-moving markets, CFD trading can trigger emotional reactions, leading to impulsive decisions. Emotions like fear and greed can drive traders to make unplanned trades, often resulting in losses. A disciplined approach, based on a well-defined strategy, is essential for avoiding emotional trades and improving long-term outcomes.

Conclusion

CFD trading presents exciting opportunities with benefits such as leverage, market flexibility, and access to diverse assets. However, it also involves significant risks, including market volatility and potential amplified losses due to leverage.

For traders in Dubai, the UAE, or anywhere in the world, understanding these benefits and risks of CFD trading is essential for successful and responsible trading. Start trading CFDs with Eonefx and explore the potential, but always prioritize informed, risk-managed trading decisions.

Frequently Asked Questions

The minimum contract size depends on the asset and the broker’s terms. Forex pairs often have smaller minimum sizes compared to commodities or indices, so it’s always best to confirm the requirements on your broker’s platform.

Commission rates vary by broker and asset. Some brokers charge commissions specifically on share CFDs, while others apply only the spread. Reviewing the fee structure before you begin can give you a clear picture of trading costs. If you’re interested in low-cost trading, visit our Open Account page to see what Eonefx offers.

Yes! One of the major benefits of CFD trading is the ability to profit from both rising and falling markets. By going long (buying) if you expect prices to rise, or short (selling) if you expect them to fall, CFDs give you flexibility that traditional investments may lack. Check out our How to Trade CFDs guide to see how this works in practice.