Top 7 Forex Trading Strategies for Beginners

By EoneFX Insights

13 February 2025

Forex trading means buying one currency while selling another. Traders do this to make a profit when currency prices change. Since the forex market runs 24 hours a day, it attracts many traders worldwide.

If you are new to forex trading strategy, you need to learn some important basics:

- Currency Pairs – Understanding which currencies are traded together.

- Trading Styles – Choosing the right style, like day trading, swing trading, or scalping.

- Risk Management – Learning how to protect your money and avoid big losses.

- Trading Strategies – Using tested methods to improve your chances of success.

Even if you have placed a few trades before, you might still be looking for a proper strategy to help you trade better. The right strategy helps you make better decisions, manage risks, and stay consistent.

In this blog, we will explain seven simple forex trading strategies that beginners use to understand the market and trade more effectively.

Key Takeaways!

Learning different forex strategies is crucial for success in forex trading. Some forex strategies focus on analyzing price movements, like trend following and price action trading, while others take external factors into account, such as news trading or carry trading.

Effective risk management is essential to protect your capital and avoid major losses. Consistent practice, backtesting strategies, and the ability to adapt to changing market conditions are all necessary to stay profitable in the forex market. By understanding and applying these forex strategies, beginners should improve their chances of making better trades and earning steady profits.

Forex Trading Strategy Basics for Beginners

A trading strategy is a plan that helps you make consistent profits in forex trading. It includes rules about when and what to buy or sell. The main goal of a strategy is to find the best times to enter or exit a trade.

Having a strategy helps reduce risks because you’ll be making decisions based on set rules instead of letting emotions like fear or greed take control. If you follow your strategy, you make better decisions, which might help you earn more profits over time.

A good strategy can also help you improve your trades. As you practice and learn, you make small changes to your strategy to get better results.

Most trading strategies use technical analysis or fundamental analysis.

- Technical traders focus on charts and numbers. They might say, “I will buy when a short-term line crosses above a long-term line.”

- Fundamental traders pay attention to news, economy reports, and company earnings. For example, they might only buy stocks after a company shows good growth or profits.

Top Seven Forex Trading Strategies for Beginners

When you start forex trading, it’s important to choose the right strategy that fits your goals and trading style. While these seven strategies may not be the absolute best for day trading beginners, they are some of the most popular ones. Each forex strategies has its own strengths and helps you understand how to approach the forex market. We’ll explain the basics of each strategy below, and you dive deeper by following the links in each section.

- Trend trading strategy

- Range trading strategy

- Breakout trading strategy

- Momentum trading strategy

- News trading strategy

- Carry trade strategy

- MACD trading strategy

Trend trading strategy

Trend trading is one of the most popular forex trading strategy. It involves using certain tools to find the direction of the market and then making trades based on that direction. In simple terms, you look for the overall trend in the market and buy or sell depending on whether the price is going up (bullish) or down (bearish).

The idea behind trend trading is that markets tend to move in certain directions for some time. By looking at past market movements, traders predict where prices will go next. However, it’s important to remember that past trends do not always predict future movements, so it’s important to manage your risks carefully.

Some common tools that traders use to identify trends are:

- Moving Averages (MAs) – This tool helps find the average price of a currency pair over a specific period. It makes the price data smoother and shows the general direction of the trend. There are two main types:

- Simple Moving Average (SMA) – It calculates the average price over a set time period.

- Exponential Moving Average (EMA) – It gives more weight to the most recent prices, making it more responsive to changes.

- Relative Strength Index (RSI) – This tool looks at the average price gains and losses over time. It helps identify whether the market is moving too much in one direction and can signal if a currency is overbought or oversold.

- Average Directional Index (ADX) – This indicator measures the strength of a trend. If the ADX value is above 25, it means the trend is strong. The higher the number, the stronger the trend.

Range Trading Strategy

The Range Trading Strategy is popular with beginners because it is simple and easy to understand. When the price of a currency moves between two set price levels over and over again, it creates a “range.” Think of it as the price bouncing up and down within a specific area.

In this strategy, traders identify the highest price point (resistance) and the lowest price point (support) within the range. When the price is near the support level (the lower part of the range), traders expect it to go up, so they buy (go long). When the price is near the resistance level (the upper part of the range), traders expect it to go down, so they sell (go short).

This best forex strategies works in both short and long-term timeframes. Traders either place their trades manually or use stop losses and limit orders. Stop-loss orders help limit your loss if the price goes against you, while limit orders set a target price at which you want to exit the trade.

The main idea is to buy when the price is low (support) and sell when the price is high (resistance), all within the range.

Breakout Trading Strategy

The Breakout Trading Strategy is a favorite of many traders because it allows them to catch a new trend early when the price starts to move quickly. A breakout happens when the price moves out of a range (above resistance or below support) and starts a new trend in a different direction.

Traders love breakouts because they often lead to fast price movements, which create more opportunities to make a profit. When the price breaks out of the range, traders open a position right away, expecting the price to continue moving in the new direction. They set a stop-loss order at the point where the price broke out, which helps protect them if the market moves back in the opposite direction.

For example, if the price breaks above a resistance level, it could signal a strong upward trend, and traders may enter the market to profit from that upward movement. Similarly, if the price drops below the support level, it might signal a downward trend, and traders may sell to profit from that fall.

Momentum Trading Strategy

Momentum Trading is a strategy where traders focus on the strength of a trend, not just the trend itself. The idea is that if a trend is strong enough, it will continue in the same direction – whether the price is going up (bullish) or down (bearish).

Traders using this Forex trading strategy aim to enter the market when the trend is gaining momentum (getting stronger) and exit when the trend starts to slow down. To determine how strong the trend is, traders look at factors like:

- Volume – the amount of currency traded

- Volatility – how much the price moves

- Timeframes – the length of time the trend has been moving

Some common tools (indicators) used for momentum trading include:

- Momentum Indicator – shows the rate of price change

- Relative Strength Index (RSI) – shows if the price is overbought or oversold

- Moving Averages (MAs) – help identify the direction of the trend

- Stochastic Oscillator – measures the momentum by comparing the closing price to the price range over time

Market sentiment is also important in momentum trading. For example, news or economic events, like an interest rate announcement, can affect currency prices. When a lot of traders believe a trend is growing stronger, they jump in, which create even more momentum.

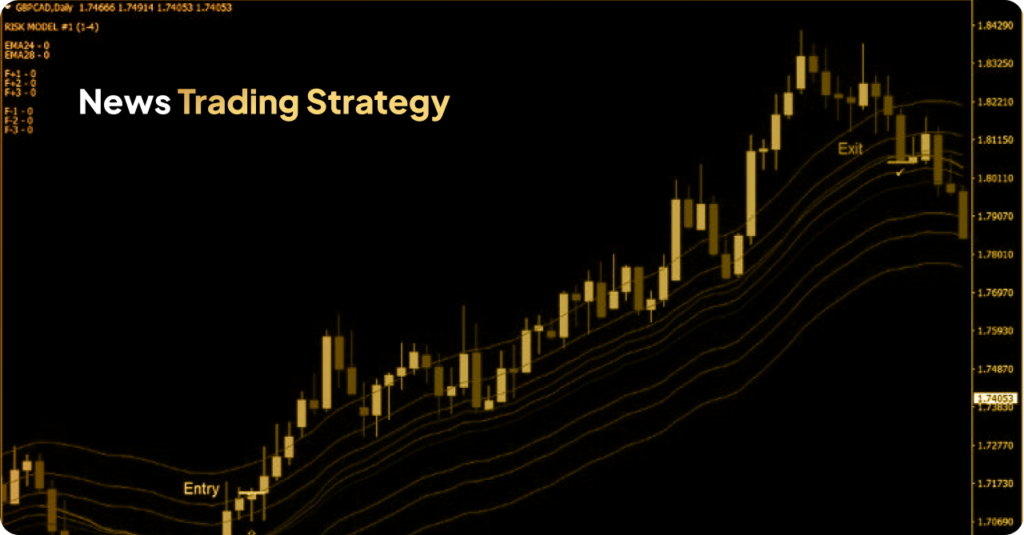

News Trading Strategy

News Trading involves using news events to make decisions about forex positions. News cause the price of a currency pair to suddenly go up or down, depending on what happens. For example, political events like elections or announcements about interest rates greatly influence the market.

If you want to trade using news, it’s important to follow the calendar of events that affect the currency pairs you are interested in. For instance, if you trade EUR/USD (Euro/US Dollar), you’ll need to follow news about both the European and American economies. This includes:

- Interest rate announcements

- Changes in monetary policies

- Elections and other political events

News events cause volatility, which is when prices change very quickly. This can be good for trading opportunities, but also risky. Always have a risk management plan in place to protect yourself from sudden price movements.

Carry Trade Strategy

The Carry Trade Strategy is based on the idea of making a profit from the difference in interest rates between two currencies in a currency pair. Here’s how it works:

- In a positive carry trade, you borrow a currency with a low interest rate and use that money to buy a currency with a high interest rate.

- In a negative carry trade, you do the opposite: borrow a currency with a high interest rate and buy a currency with a low interest rate.

With a positive carry trade, you earn interest on the currency you bought, which gives you an initial profit. However, if the market moves against you, there could be a loss. In a negative carry trade, you might start with a small loss because you’re paying more interest on your position, but if the market moves in your favor, it could lead to a profit.

The goal of a carry trade is to make money from the difference in interest rates, but keep in mind, this strategy is affected by factors like interest rate changes and market conditions.

MACD Trading Strategy

MACD stands for Moving Average Convergence Divergence, and it helps identify when a trend is changing in the market. It’s a useful strategy for traders who are familiar with using indicators.

The MACD is made up of three parts:

- MACD Line – This is the difference between two moving averages (a 12-period and a 26-period moving average).

- Signal Line – This is the 9-period moving average of the MACD line.

- Histogram – This is a bar chart that shows the difference between the MACD line and the signal line.

When the MACD line (the blue line) crosses above the signal line (the red line), it’s a buy signal, suggesting it’s a good time to enter a trade. If the MACD line crosses below the signal line, it’s a sell signal, meaning it’s a good time to exit or open a short position.

This strategy works well for identifying when trends are likely to end and when a new trend is about to start.

How to Start Trading Forex as a Beginner

If you’re new to forex trading, it might feel a bit overwhelming at first. But don’t worry—starting is easier than you think. Best forex trading strategies is about buying and selling currencies with the goal of making a profit. The forex market is one of the largest and most active in the world, offering lots of opportunities for traders. However, it’s important to get the basics right before jumping in.

To help you get started, we’ve outlined a simple step-by-step guide. By following these steps, you’ll be able to understand how the market works, set clear goals, and start trading with confidence. It’s crucial to have a trading plan, understand the risks, and practice before risking real money.

- Understand Forex Trading

Learn what forex trading is and how the FX market works. It’s important to know the basics before you start trading. - Create a Trading Plan

Make a plan that suits your goals. Stick to it! Your plan should include how much money you want to risk and what your trading strategy will be. - Open a Trading Account

Open a forex trading account with a trusted broker, like us. This account will allow you to buy and sell currency pairs. - Pick a Forex Pair

Choose a forex pair to trade. This means picking two currencies you want to exchange, like EUR/USD or GBP/JPY. - Start Your First Trade

Once you’ve picked your currency pair, you’re ready to open your first trade. You’ll buy or sell the currency pair based on what you think will happen next.

If you need more help, get in contact with our forex trading in Dubai at Eonefx. It offers free online courses to help you improve your forex skills. You should also practice your trades in a demo account, where you’ll get £10,000 in virtual funds to try out your strategies without any risk.

Forex Trading Strategies for Beginners Summed Up

Forex trading means buying and selling currencies to make a profit. To start forex trading, you need to understand currency pairs and how to manage risk. There are different ways to trade, and here are a few strategies to help you:

- Trend Trading: This strategy uses special tools to find the direction of the market and follow the trend.

- Range Trading: Here, you look for currencies that stay within a certain price range. You decide whether to buy or sell depending on where the price is in that range.

- Breakout Trading: This means you open a trade early when a new trend starts and set a stop-loss to protect your trade.

- Momentum Trading: In this strategy, you open a trade when a trend is getting stronger and close it when the trend starts slowing down.

- News Trading: You follow important news and events (like elections or economic reports) that change the price of currencies.

- Carry Trade Strategy: You earn profit from the difference in interest rates between two currencies.

- MACD Trading: This strategy uses two moving averages to give you signals on when to buy or sell.

To get started as a beginner, learn as much as you can with our forex trading in UAE at Eonefx, and then open a demo account to practice without real money.

The Bottom Line

Forex trading offers many opportunities, but it’s important to approach it with a clear strategy. Whether you choose trend trading, range trading, or any of the other strategies, make sure to understand how each works and practice with a demo account first. Always remember to manage your risks and keep learning. With time and experience, you must improve your skills and increase your chances of success in the forex market.